Depreciation expense calculator for rental property

Ginning in 2021 the maximum section 179 expense de-duction is 1050000. Unlike a Section 179 deduction bonus depreciation is.

Residential Rental Property Depreciation Calculation Depreciation Guru

Below is the explanation of the values that are required to add to the calculator for calculation.

. 10-year property 15-year property 20-year property 25-year property 275. Please see TaxTims handy Wear and Tear calculator to help you calculate the deduction. Follow these 8 tips to increase your chances of successful rental property investment.

The most common depreciation is called straight-line depreciation taking the same amount of depreciation in each year of the assets useful life. By convention most US. At the time of sale.

A great rental property calculator takes the guesswork out of forecasting your cash flow and makes it much easier to grow a profitable portfolio. This limit is reduced by the amount by which the cost of section 179 property placed in serv-ice during the tax year exceeds 2620000. Calculate depreciation and create a depreciation schedule for residential rental or nonresidential real property related to IRS form 4562.

But businesses may also estimate a higher salvage value. A general depreciation system uses the declining-balance. Final value residual value - The expected final market value after the useful life of the asset.

Can I claim depreciation for my car if I have kept a logbook. Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years begin-ning in 2021 is 26200. Period - The estimated useful life span or life expectancy of an asset.

Im a sole proprietor. Income-to-Expense Ratio the 1 rule Gross Rent Multiplier. It is quite easy to use just follow the given steps to calculate your property.

In step-by-step go to the page for the specific rental property ie 1234 Maple Street. Be sure to enter the number of fair rental and personal-use days on line 2. Some companies estimate an assets salvage value to be 0 by the end of its term.

The very last item on the page is Dispose of Rental Property Assets. Property depreciation for real estate related to. Charts that show projected income expenses and cash flow projections for the next 30 years.

Here are a few things you need to consider before you invest in a rental property. During the 10-year ownership period. Landlord tax deductions include just about every conceivable expense associated with rental properties plus some just-on-paper expenses.

This could either be for book-keeping records following the depreciation expense period or because a company wants to sell the assets remaining value. 23670 x 25 maximum tax rate 5918 tax paid on depreciation recapture. The upper half of the screen is for income for that rental property the bottom half for expenses.

Before you jump into purchasing a rental property consider repaying all sorts of personal debt including student loans or unpaid medical bills. General Depreciation System - GDS. Depreciation commences as soon as the property is placed in service or available to use as a rental.

If you have more than three rental or royalty properties complete and attach as many Schedules E as. These properties might also qualify for a special depreciation allowance. City replaced water lines for an assessment of 4000 easement granted to the next-door neighbor for building their fence on your side of the property line 1000 total depreciation expense of 41090.

Depreciation Recapture is when real property is sold at a gain and depreciation had been claimed. Investing in rental property can be lucrative but it can come with many challenges. List your total income expenses and depreciation for each rental property.

This is a formula that rental property investors use to size up a propertys cash flow quickly. Uses mid month convention and straight-line depreciation for recovery periods of 22 275 315 39 or 40 years. For an estimate of deductions you may be entitled to or to have your current depreciation schedule reviewed free of charge please dont hesitate to get in.

4734 annual depreciation expense x 5 years 23670 total depreciation to recapture. To determine the amount youll be taxed on your depreciation recapture use our depreciation recapture tax calculator. Top Six Property Negotiation Tips For Home.

Yes youd be able to depreciate your car over five years but youd to apportion this expense based on the ratio of business to personal mileage. Real Estate Investment Calculator. Depreciation recapture a provision the IRS uses to tax the profitable sale of a rental property on which the owner has previously claimed depreciation can have a great impact on an investors bottom line.

Cost basis for capital gains on a rental property sale. The most commonly used modified accelerated cost recovery system MACRS for calculating depreciation. The math is a bit more complex than well want to dive into here but to get a ballpark of your expenses you can enter the cost of your property and other variables into a property depreciation.

Special depreciation rules apply to listed. This calculator performs calculation of depreciation according to the IRS Internal Revenue Service that related to 4562 lines 19 and 20. Not limited to an annual dollar amount.

Certain property with a long production period. Depreciation isnt an actual expense that you need to pay but an accounting entry. Qualified GO Zone property placed in service before Dec.

Qualified Liberty Zone property placed in service before Jan. Read more about rental property depreciation before writing it off and use our rental property depreciation calculator to make your life easier. Our property depreciation calculator helps to calculate depreciation of residential rental or nonresidential real property.

Asset value - The original value of the asset for which you are calculating depreciation. Tax benefit cost 2. Rental property sold for 134400 including selling expenses.

A good rule of thumb is the 1 percent rule. The MARCS depreciation calculator creates a depreciation schedule showing the depreciation percentage rate the depreciation expense for the year the accumulated depreciation the book value at the end of the year and the depreciation method used in calculating. Depreciation Recapture for Rental Properties.

The rule stipulates that the propertys total rental income should be 1 percent of the purchase price at a minimum. Residential rental property is depreciated at a rate of 3636 each. For example the first-year calculation for an asset that costs 15000 with a salvage value of 1000 and a useful life of 10 years would be 15000 minus 1000 divided by 10 years equals 1400.

If you own an investment property the best way to ensure your depreciation deductions have been maximised is to use a depreciation schedule prepared by Capital Claims Tax Depreciation. While bonus depreciation is used to expense improvements to a rental property Section 179 of the IRS tax code allows an investor to deduct the purchase price of equipment such as autos office equipment or computers subject to certain limitations. When a rental property is sold the adjusted cost basis is used to calculate the profit on the sale and the capital gains tax.

Use the investment property calculator to accurately predict the weekly cashflow position of your next investment property. Depreciation rules for listed property.

Rental Property Depreciation Calculator Cheap Sale 52 Off Www Ingeniovirtual Com

Rental Property Cash On Cash Return Calculator Invest Four More

Straight Line Depreciation Calculator And Definition Retipster

Residential Rental Property Depreciation Calculation Depreciation Guru

Depreciation Schedule Template For Straight Line And Declining Balance

Depreciation Schedule Formula And Calculator Excel Template

8 Powerful Real Estate Investment Calculators A Full Review

Renting My House While Living Abroad Us And Expat Taxes

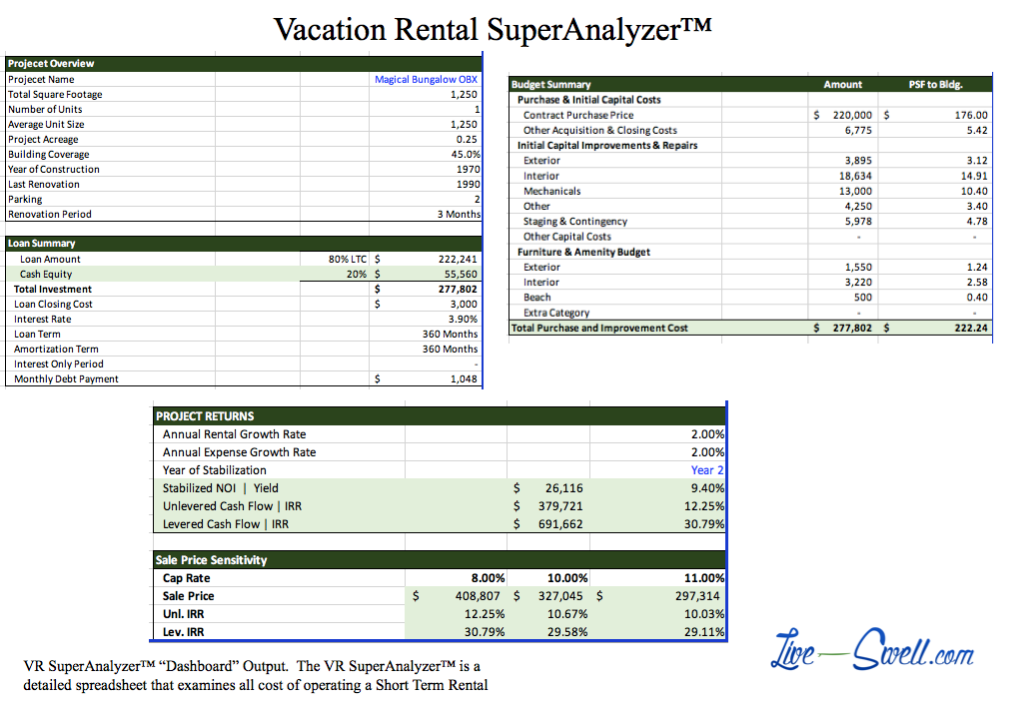

Vacation Rental Expenses Done Smart Easy Free Calculator Live Swell

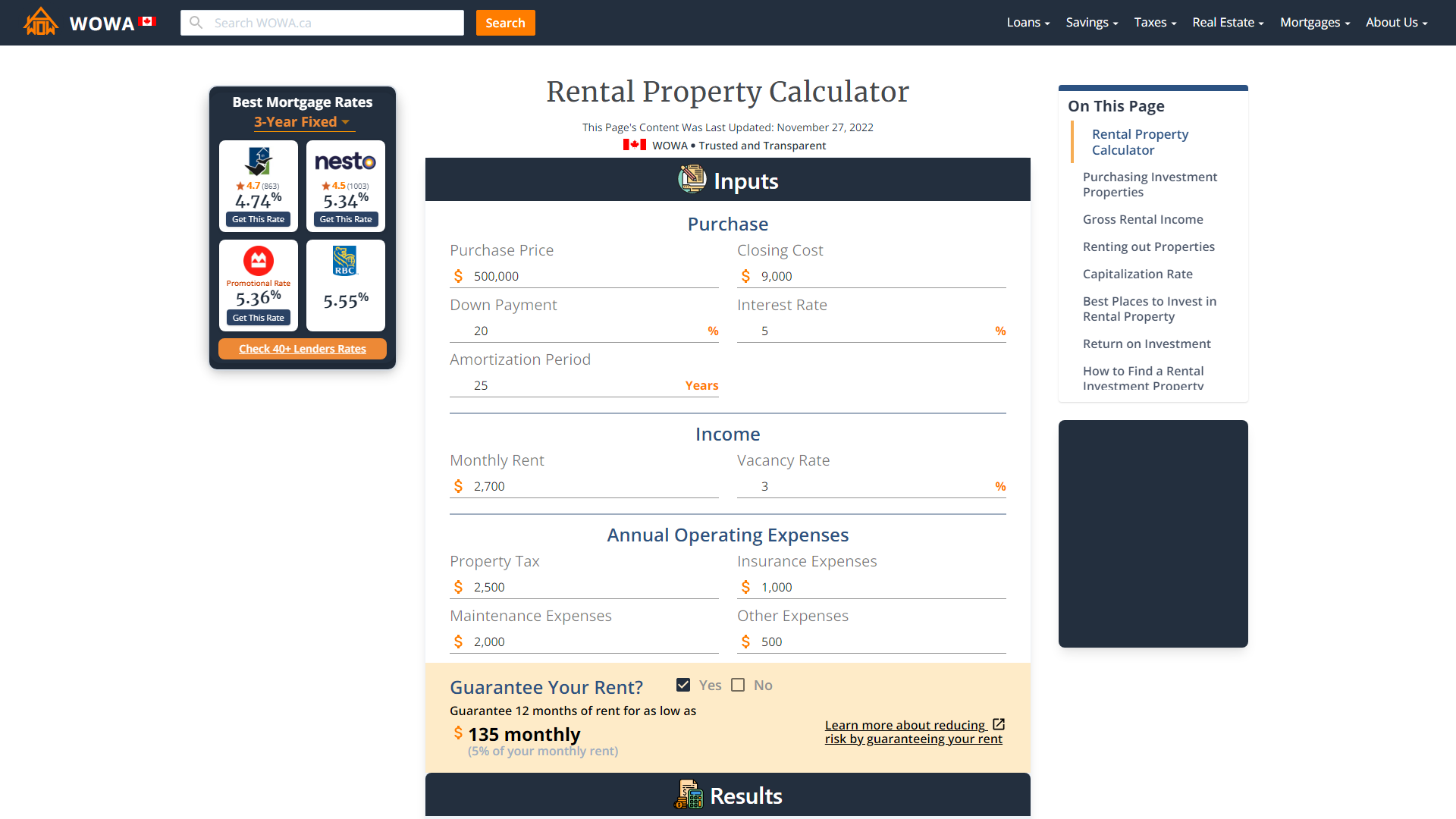

Rental Property Calculator 2022 Wowa Ca

Depreciation Formula Calculate Depreciation Expense

Free Macrs Depreciation Calculator For Excel

Macrs Depreciation Calculator With Formula Nerd Counter

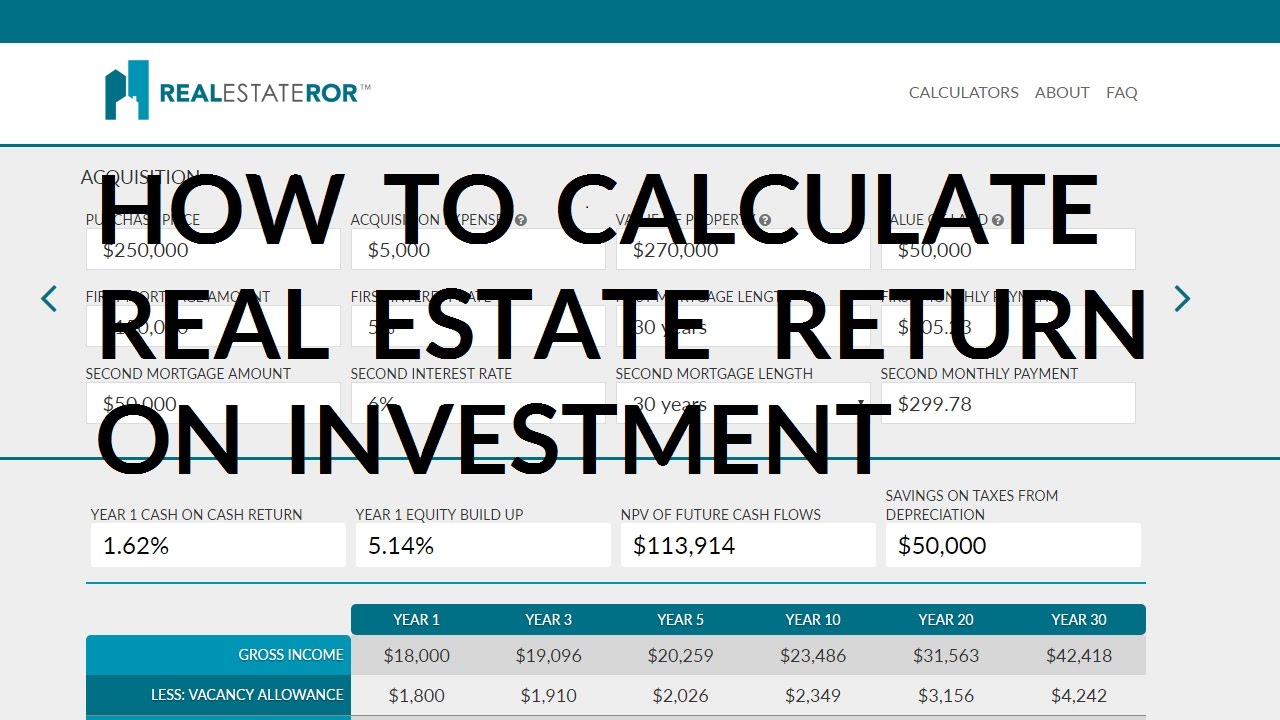

How Do You Calculate Return On Investment On Rental Property

3 Ratios To Start Tracking Now Rental Property Calculator Accidental Rental

Rental Property Calculator Most Accurate Forecast

Depreciation For Rental Property How To Calculate